Credit can be a powerful tool, but for those with a less than perfect financial history, obtaining a loan may seem daunting. However, bad credit loans with monthly payments can provide a lifeline for those in need of financial assistance. These loans come with the advantage of monthly payment options, making repayment more manageable. It’s crucial to understand the implications of taking on such a loan, as high interest rates are often associated with bad credit loans. This guide will explore into the world of bad credit loans with monthly payments, providing insights on how to navigate this financial landscape.

Key Takeaways:

- Bad credit loans with monthly payments can provide individuals with poor credit history an opportunity to borrow money while spreding out the repayment over managable monthly installments.

- Repaying loans on time can help improve credit scores as lenders report payment history to credit bureaus, showing responsible financial behavior.

- Compare interest rates and fees from multiple lenders before applying for a bad credit loan with monthly payments to ensure you are getting the best deal possible.

Types of Bad Credit Loans with Monthly Payments

You may be in a tough financial situation with a bad credit history, but there are bad credit loans with monthly payments available to help you out. Understanding the different types of loans can help you choose the best one that fits your needs. Here are some options:

| Secured Loans | Unsecured Loans |

| Payday Loans | Installment Loans |

| More info below | More info below |

Secured Loans

An option for individuals looking to borrow a larger sum of money, a secured loan requires collateral such as a car or home, lowering the risk for the lender. The monthly payments are typically lower with this type of loan. After paying off the loan successfully, you can improve your credit score.

Unsecured Loans

Loans without collateral, unsecured loans are based solely on the borrower’s creditworthiness. The interest rates for unsecured loans with bad credit are higher due to the increased risk for the lender. This type of loan is suitable for smaller amounts and shorter terms.

This type of loan may be harder to qualify for with a bad credit score, but it provides flexibility in how you can use the funds. Consider using Best Installment Loans for Bad Credit in March 2024 options when exploring unsecured loans.

Payday Loans

Clearly targeted at individuals who need immediate cash, payday loans have a quick approval process but come with extremely high interest rates. These loans should be a last resort due to the potential debt trap they can create if not paid back on time.

With the convenence of getting funds quickly, payday loans can be tempting. However, make sure to weigh the risks before proceeding with this type of loan.

Installment Loans

Secured installment loans allow you to borrow a fixed amount of money that you repay in regular installments over a set period. These loans with monthly payments have a specified repayment schedule, making it easier for borrowers to budget their finances and manage debt responsibly.

When considering installment loans, compare offers from different lenders to find the most favorable terms and rates for your financial situation.

Factors to Consider Before Taking a Bad Credit Loan

Your financial situation and credit history play a significant role in determining the terms and conditions of a loan. It is important to consider interest rates, loan terms, lender’s reputation, and borrower’s payment capability before taking on a bad credit loan.

Interest Rates

Loan interest rates for individuals with bad credit are typically higher than those with good credit. Be sure to research and compare rates from different lenders to find the most favorable terms for your financial situation.

Loan Terms

Little details in the loan terms can affect your repayment schedule, interest payments, and overall cost of the loan. The length of the loan, monthly payments, and any additional fees should be carefully reviewed before signing any agreements.

Lender’s Reputation

Consider the reputation of the lender before agreeing to any loan terms. Research the lender’s background, read reviews, and check for any complaints or negative feedback. Terms and conditions set by reputable lenders are more likely to be transparent and fair to borrowers.

Borrower’s Payment Capability

Lenders will assess a borrower’s payment capability before approving a loan. It is crucial for borrowers to accurately evaluate their financial situation and ensure they can meet the monthly payment obligations. Borrowing more than you can repay could lead to further financial strain and damage to your credit score.

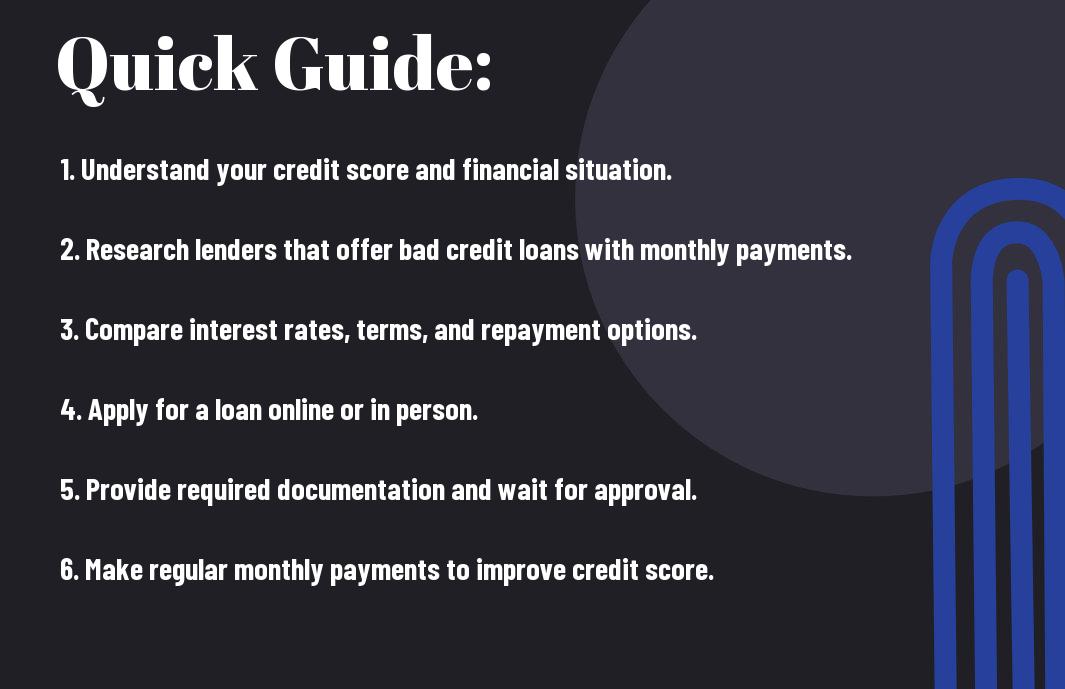

Step-by-Step Guide to Applying for a Bad Credit Loan

After Installment Loans Online, the next step is to apply for a bad credit loan. Here is a breakdown of the process: Checking Your Credit Score While applying for a bad credit loan, it’s imperative to check your credit score. Lenders often consider this when determining your loan terms. You can request a free copy of your credit report from the three major credit bureaus. Comparing Lenders and Offers Guide When comparing lenders and offers, it’s crucial to look at the interest rates, repayment terms, and any fees associated with the loan. Consider multiple options to find the best deal that fits your financial situation. Credit Preparing Necessary Documentation Documentation Before applying for a bad credit loan, gather documents such as proof of income, identification, and bank statements. Having these ready can expedite the application process and increase your chances of approval. Completing the Application Process There’s a final step in the application process where you’ll need to provide personal and financial information. Be truthful and accurate in your application to avoid any discrepancies that could lead to a denial. Double-check all details before submitting the application.

Tips for Managing Bad Credit Loans with Monthly Payments

Now, when it comes to managing bad credit loans with monthly payments, it’s vital to have a solid plan in place to handle your finances. Here are some tips to help you stay on track:

Budgeting for Monthly Payments

Managing your budget effectively is crucial when dealing with bad credit loans with monthly payments. Make sure to allocate enough funds each month to cover your loan payments and other vital expenses. Consider creating a detailed budget to track your income and expenses to ensure you can make timely payments.

Strategies for Paying Off Loans Early

Paying off your bad credit loans early can help you save money on interest payments in the long run. Consider making extra payments whenever possible or rounding up your monthly payments to accelerate the payoff process. Another strategy is to consolidate your debts to streamline payments and potentially lower your interest rates. Perceiving your loan terms and interest rates can help you determine the best approach for early repayment.

Understanding Grace Periods and Late Fees

Loans may come with grace periods that allow you some extra time to make payments without incurring late fees. However, it’s crucial to understand the terms of these grace periods to avoid any penalties. Make sure to familiarize yourself with the late fee structure and prioritize making payments on time to maintain a good financial standing. Awareness of these policies can help you avoid unnecessary fees and protect your credit score.

Seeking Professional Financial Advice

With bad credit loans, seeking professional financial advice can provide invaluable guidance on managing your debts effectively. Financial advisors can help you create a customized repayment plan based on your financial situation and goals. For instance, they can offer insights on debt consolidation options or negotiate with lenders on your behalf to improve your repayment terms. Their expertise can help you make informed decisions and take control of your financial future.

Pros and Cons of Bad Credit Loans with Monthly Payments

| Pros | Cons |

| – Opportunity for individuals with bad credit to access funds | – Higher interest rates compared to traditional loans |

| – Monthly payments provide a structured repayment plan | – Potential for a cycle of debt if not managed properly |

| – Can help improve credit score with timely payments | – Limited loan amounts available for those with bad credit |

| – Quick approval process for those in urgent financial need | – Some lenders may have hidden fees or high penalties for late payments |

Pros

If you have bad credit and are in need of financial assistance, bad credit loans with monthly payments can be a viable solution. These loans provide the opportunity to access funds quickly through a straightforward online application process. By making your repayments on time, you can also start rebuilding your credit score gradually. For convenient and accessible personal installment loans online, you can check out Personal Installment Loans Online.

Cons

Clearly, one of the main drawbacks of bad credit loans with monthly payments is the higher interest rates they come with. This can significantly increase the overall cost of borrowing. Additionally, if not managed properly, these loans can trap individuals in a cycle of debt, leading to financial stress and further damage to their credit score. It’s important to carefully consider your financial situation before taking on such a loan.

Monthly payments can provide a structured way to repay your loan, but individuals need to be aware of the potential risks involved. High-interest rates and limited loan amounts available for those with bad credit can make it challenging to meet the repayment terms. It’s crucial to consider all aspects of the loan before committing to ensure you can manage the repayments effectively.

Summing up

So, whether you are looking to consolidate debt, cover unexpected expenses, or improve your credit score, bad credit loans with monthly payments can be a viable option for you. By making on-time monthly payments, you can gradually rebuild your credit history while meeting your financial needs. Just remember to carefully consider the terms and interest rates offered by different lenders to ensure that you are getting the best possible deal for your situation. With responsible borrowing and timely payments, bad credit loans with monthly payments can help you take control of your finances and move towards a more secure financial future.

FAQ

Q: What are Bad Credit Loans with Monthly Payments?

A: Bad Credit Loans with Monthly Payments are loans designed for individuals with poor credit scores. These loans have repayment plans that require borrowers to make monthly payments over a specified period of time.

Q: How do Bad Credit Loans with Monthly Payments work?

A: To qualify for a Bad Credit Loan with Monthly Payments, individuals need to apply to a lender specializing in such loans. The lender will assess the borrower’s creditworthiness and determine the loan amount and interest rate. Once approved, the borrower needs to make timely monthly payments until the loan is fully repaid.

Q: What should I consider before applying for a Bad Credit Loan with Monthly Payments?

A: Before applying for a Bad Credit Loan with Monthly Payments, consider the interest rate, loan term, monthly payment amount, and total cost of the loan. It’s crucial to ensure that you can afford the monthly payments and understand all terms and conditions before committing to the loan.

This is a good article, there is a bunch of information in it. You explain what the entire title is about, what is a bad credit loan? you explained that, what the monthly payments look like with such loan, you explained that. what is secured, and unsecured and the difference, you covered that. I’m amazed with all the information you were able to pack into this article, and it is very helpful for those who would be seeking a loan of this capacity. There is even a frequently asked questions section of this article, from my point of view, anyone seeking any information around this topic should hopefully come cross this page, because I found it very informative. Not only are the facts behind this topic is covered, but the writer also points out the negatives of this type of loan. This loan isn’t for everyone, and there are mindsets involved with taking on the responsibility of this type of loan. All that is covered in this article, so I find it very helpful that the writer not only sells this idea of a bad credit loan but also shares the precautions that should be taken before taking on this responsibility.

Thank you so much, Thomas, for taking the time to read and appreciate my article! I’m thrilled to hear that you found it informative and packed with valuable information about bad credit loans. It was my intention to cover all aspects comprehensively, from what these loans entail to their potential drawbacks, to ensure readers have a holistic understanding before making any decisions.

Indeed, bad credit loans can be a useful financial tool for some individuals, but it’s equally important to highlight the responsibilities and potential risks involved. By providing a balanced perspective, my aim is to empower readers to make informed decisions that align with their financial circumstances and goals.

Your feedback encourages me to continue creating content that is both educational and insightful. If you have any further questions or topics you’d like to see covered, please don’t hesitate to reach out. Thank you again for your kind words and for sharing your thoughts!

Jeff