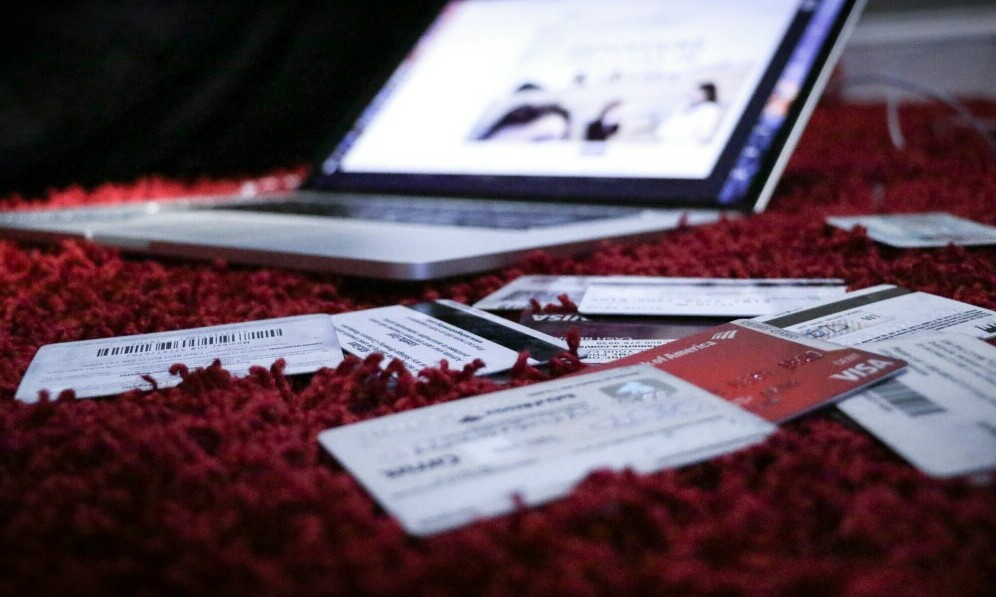

let me talk about credit repair and why it’s crucial for your financial health. Credit repair is about securing your financial future. Poor credit can slam the brakes on your ability to land a decent mortgage rate, finance a car, or even snag certain jobs.

Now, what leads to the need for credit repair? It’s often the result of missed payments, maxing out credit cards, or falling victim to identity theft. But here’s the kicker: Even simple mistakes or oversights on your credit report can wreak havoc on your credit score.

You’re going to find out that a subpar credit score doesn’t just haunt you when trying to borrow money; it can inflate your insurance premiums and even act as a barrier to renting a home. In my opinion, understanding the repercussions of damaged credit is the first step toward fixing and fortifying your financial standing.

So now that you know the ‘who’ and ‘why’ let’s move on to the ‘how.’ In the next section, I’ll guide you through assessing your credit report. It’s the critical first move in the credit repair dance and believe me, ensuring accuracy in this document is a non-negotiable starting point.

Assessing Your Credit Report: The First Step to Recovery

If you want to set the stage for credit repair, the real magic starts with your credit report. Think of it as the report card for your financial history. It’s going to include all your past financial behaviors, and it’s what lenders look at to determine your creditworthiness.

Now, you’re entitled to a free credit report each year from the three major bureaus: Experian, Equifax, and TransUnion. I’m here to help you understand how to get your hands on those reports without a hitch. Besides, once you’ve grasped the three reports, you can address any discrepancies head-on.

You’re going to find out about the finer details of your credit report, like account histories, debt amounts, and payment timelines. Make sure to comb through every detail for inaccuracies. Even a small error can wrongly impact your credit, so disputing mistakes is a crucial move.

And hey, don’t get discouraged if it seems complex. You can always adjust your approach down the road. But right now, spotting errors and flagging them for correction is your main goal. We’ll get to how those actions connect with quick credit score improvements in a moment.

Strategic Actions for Quick Credit Score Improvements

Improving your credit score doesn’t have to be a drawn-out process. With some strategic actions, you can start to see improvements quickly. One of the most critical steps you can take is to ensure you’re paying all your bills on time, every time. Late or missed payments can severely impact your credit score, so it’s crucial to stay on schedule.

Another game-changer is your credit utilization ratio, which is the amount of credit you’re using compared to your available credit limits. High utilization can signal risk to lenders and hurt your score. Try to pay down balances and keep your ratio below 30% of your limits. It’s also wise to avoid closing unused credit card accounts abruptly as this may negatively affect your utilization ratio.

It might be tempting to apply for a new credit line, but each application can result in a hard inquiry into your credit. Too many hard inquiries can indicate that you’re desperate for credit, which may decrease your score. If you don’t need new credit immediately, steer clear of new applications for a while.

Lastly, don’t underestimate the power of communication with your creditors. If you’re struggling to make payments, it’s often beneficial to reach out and negotiate payment terms that work better for your financial situation. Creditors may offer options such as lowering interest rates or forgiving part of your debt, which can make it easier for you to pay off your balances and improve your credit score.

These steps not only lead to a quick boost in your score but also pave the way for better credit management. In the next part of the conversation, we’ll explore how you can maintain your newfound credit health and make sure it’s sustainable over the long haul.

Maintaining Your Credit Health: Sustainable Practices

Now, maintaining a healthy credit score isn’t a sprint; it’s more like a marathon. It involves developing and sticking to good financial habits over the long haul. Starting off strong with quick repairs is great, but keeping that momentum is key.

You’re going to find out that regularly monitoring your credit can catch mistakes early and even help in identifying potential fraud. Tools like credit monitoring services are valuable for staying on top of changes to your credit report.

Here’s another piece of advice: choose credit accounts and loans wisely. Each account should serve a purpose for your financial growth. And remember, applying for new credit should be strategic, not impulsive, to minimize hard inquiries that may affect your score negatively.

But what about using the credit you already have? That’s going to include things like keeping your credit card balances low and paying them off in full whenever possible. It’s also about understanding the terms of each credit product and making informed decisions on borrowing and spending.

In my opinion, one of the most underrated aspects of credit health is patience. Improvement takes time, and so does building a robust credit history. Don’t worry too much about day-to-day fluctuations; focus on consistent, responsible financial behavior.

And finally, if you ever feel overwhelmed, don’t hesitate to seek help from credit counseling services. These professionals can offer personalized advice and help you make a plan that resonates with you and your financial goals.

I really hope that this walk through quick credit repair tips has been helpful. Your journey to a better credit score is important, not just for your financial options today, but for those you’ll want in the future. Keep the course steady, and you’ll be on track for financial health and freedom before you know it.

This article is very timely for me because I just renewed our mortgage.

I learned lots of value here, especially the strategic actions to improve credit score, including the credit utilization ratio.

I wonder if changing credit cards every year or two, would affect your credit score. Some credit cards offer points that can be used for travel or groceries. Thus, it is tempting to use newer credit cards after a while since they offer more points initially.

I hope you can give me some advice.

Marita

Hi Marita,

I’m glad you found the article helpful! Renewing a mortgage can indeed prompt a lot of financial considerations, including credit score management. Regarding your question about changing credit cards, it’s understandable to be tempted by enticing offers like bonus points.

Switching credit cards periodically may affect your credit score, but the impact varies depending on several factors. Opening a new credit card can result in a hard inquiry on your credit report, which may temporarily lower your score. Additionally, closing old credit card accounts can impact the average age of your accounts, another factor in your credit score calculation.

However, if you manage your credit responsibly by paying bills on time and keeping your credit utilization low, the impact of opening new cards should be minimal and short-lived. In fact, having a diverse mix of credit types (such as credit cards, mortgages, and loans) can actually benefit your credit score in the long run.

Before making any decisions, it’s essential to weigh the potential benefits of new credit card offers against their potential impact on your credit score. If the rewards outweigh the potential score dip and you can manage the new cards responsibly, it could be worth considering.

Remember to monitor your credit score regularly and consider consulting with a financial advisor for personalized advice.

#CreditScore #CreditCards #FinancialAdvice #MortgageRenewal

Jeff