When I talk about ‘very bad credit’, I’m referring to a credit score that falls at the lower end of the scale. Credit scores, which range from 300 to 850, can determine the kind of financial deals you’re eligible for, and a very low score can close some doors on you. It’s essential to grasp the gravity a low score carries; it’s not just a number but a financial identity that lenders use to gauge risk.

A ‘very bad’ credit score doesn’t just throw a wrench in your ability to get personal loans; it can affect renting an apartment, getting reasonable insurance rates, and even impact your job prospects. Lenders typically hesitate to approve loans for individuals with such credit profiles because they’re seen as high-risk borrowers.

The reasons for landing in the ‘very bad credit’ bracket can vary widely from persistent late payments to defaulting on previous loans. It’s important for you to understand that this isn’t necessarily a permanent stain on your financial record; there are ways to manage and improve your credit over time.

But if you’re in a situation where you need a personal loan now, don’t lose hope. The next section will look closely at what your options are, highlighting various types of loans and lenders who might be able to help, despite your credit challenges.

Evaluating Your Options: Navigating Personal Loans with Very Bad Credit

If you’re facing the challenge of very bad credit, you might feel your options for personal loans are limited. But even in this tight spot, you do have choices. It’s essential to understand what these options entail so you can make an informed decision that won’t worsen your financial situation.

Secured loans are one avenue to consider. With these loans, you’ll provide an asset as collateral, which could mean better interest rates and terms than unsecured loans. On the flip side, defaulting could result in losing your asset, so it’s vital to weigh the risks carefully.

Unsecured loans don’t require collateral, making them a less-risky choice in terms of personal assets. However, the trade-off is typically higher interest rates and more stringent approval requirements, given that the lender has less security. For those with very bad credit, approval for unsecured loans can be difficult and costly.

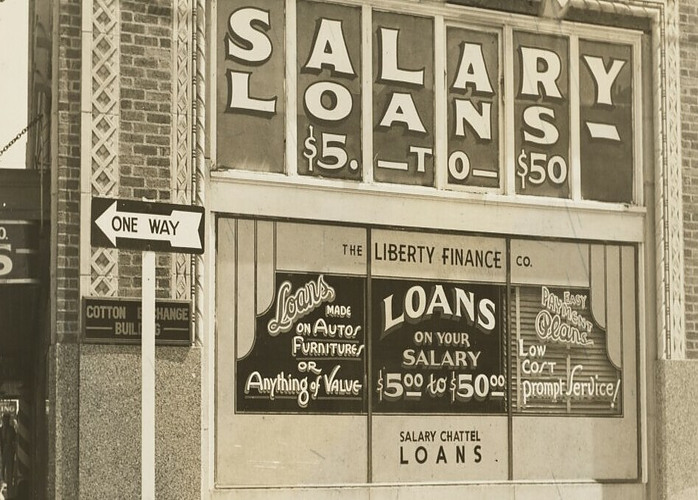

Beyond traditional loans, you might encounter payday loans or title loans as options. These are short-term fixes that often come with extremely high-interest rates and fees. While they might seem like a quick solution, they can easily lead to a cycle of debt that’s hard to break free from.

Considering online lenders might offer some advantages, like more flexible terms and a simpler application process. But it’s important to be cautious—online lending is a space with both legitimate businesses and less scrupulous operators.

Next, I’ll walk you through the importance of thoroughly vetting lenders to ensure you’re not falling into a trap with predatory terms that only worsen your financial health.

Building Trust: How to Vet Lenders and Avoid Predatory Practices

When faced with the need for a personal loan, having very bad credit can send you searching through less traditional avenues. It’s my responsibility to caution you that this territory is where you’re most likely to encounter predatory lenders. They know you’re desperate and they bank on it – quite literally.

It’s the cunning and often hidden terms in these loan agreements that can exacerbate your financial woes. I’m talking about sky-high interest rates, hefty fees for late payments, and balloon payments that can be impossible to meet.

Do your homework. Any lender you consider should be subject to a thorough background check. You’re looking for a trustworthy partner in your financial recovery, not a detriment to it. Visit their website, read testimonials, and search for independent reviews. The Consumer Financial Protection Bureau is an excellent place to start when verifying a lender’s legitimacy.

Questions are your best defense against becoming ensnared in a loan with punishing terms. Ask about the annual percentage rate (APR), payment schedule, and any additional fees. If they’re not upfront about these aspects, consider it a MASSIVE red flag.

I can’t overstate the importance of understanding the full scope of the agreement before you sign. This isn’t just about getting through the next few months; it’s about laying the groundwork for financial stability.

Path to Improvement: Repairing Your Credit for the Future

I understand the hardship that comes with having very bad credit. It feels like a financial shackle, limiting your options. But I have some good news: there are actionable steps you can take to repair your credit and improve your financial footing.

First, focus on developing a clear plan. This plan will involve regularly checking your credit report for errors and discrepancies. If you find any, dispute them promptly. It’s your legal right to have an accurate credit report.

Next, start building a positive borrowing history. Consider getting a secured credit card or a credit-builder loan. These products are designed specifically for individuals like you looking to improve their credit. Use them wisely: never miss a payment and keep your credit utilization low.

I also recommend setting up payment reminders or automatic payments. Consistency is key for credit improvement, and timely payments are the most significant factor in credit scoring models.

If you have outstanding debts, work out a payment plan or consider talking to a credit counselor. These professionals can provide guidance on managing debt and creating a budget that works for your situation.

Stay patient and persistent. While it’s true that repairing credit takes time, each positive step is a building block towards a more secure financial future. As your credit improves, you’ll have better access to financial products, and you’ll likely get them on more favorable terms.

Remember: the path to better credit is intertwined with responsible financial habits and choices. By taking control of your financial decisions now, you’re paving the way for a healthier credit score—and with it, a more robust financial profile, in the long run.